Golden Guide To Precious Metals

Why Own Gold & Silver

Physically owning precious metals namely gold and silver is a very important part of sustaining wealth. Simply put "if you don't hold it you don't own it."

Gold and silver have been and will continue to be reliable forms of currency and wealth preservation, as well as alternate avenues to grow wealth. These metals are intertwined with the development of human civilization. Thus they hold value regardless of time and place, and can be used without the need for electronics required for digital currencies.

It is essential to understand and recognize that gold is only one tool

among many financial tools. It is ideal for accomplishing certain tasks and acts as a good asset if it is used the right way in the appropriate conditions. There are certain conditions where it will perform well and certain conditions or tasks where it will be limited in its potential.

Precious metals shine when they are used for the following purposes under the following circumstances. First and foremost as mentioned the main strength of gold is its use as a stable long term form of wealth preservation that is constantly resistant to loosing value from inflation. This is often best done during times of economic decline and times of uncertainty when the future of other assets such as stocks and real-estate is less clear and reliable. Age old phrases like "old but gold" and "cash is trash" are largely true when the primary function of gold and silver in modern times is an inflation hedge because historically they have kept up with inflation. An ounce of gold retains its buying power over time. The same quantity of goods can generally be bought with the same approximate quantity of gold, as opposed to cash and digital currencies which are less constant in value.

Gold and silver can also grow wealth considerably

but this is a secondary concern as it is usually confined to gold crafted into jewelry and coins rather than the sole rise in the value of the metal alone. Investors often downplay or even despise precious metals because they are misunderstood and wrongly labeled as alternate forms of savings and not investments that grow. This stance is true to a low extent as it is largely misguided. Gold and silver especially when not crafted into coins and jewelry are not generally going to produce massive returns unless the metals are bought when their market price drops considerably. Precious metals themselves are sometimes referred to as "non-productive assets" in that they doesn't produce anything like a business. Instead their primary value is derived from physical rarity and historic scarcity, along with esthetic appeal to humans, and use in electronics (namely silver as a highly efficient conductor of electricity). There is a finite amount of gold on earth and that is a large part of why it remains so stable in value. Thus gold is not as strongly linked or dependent on other markets. It is best used to compliment other assets rather than replace them.

What Forms Of Gold & Silver To Own

Now that you know the power and limitations of precious metals you are probably asking

how much gold and silver you should own?

This is a broad question but generally it has been common to have 5-15% of assets in the form of precious metals. This amount allows for balance and flexibility for the positive effects of precious metals to balance out negative drops in wealth from other assets such as stocks, real-estate, and currencies. While at the same time not hindering the overall growth of all combined assets. Just to be extra clear, 5-15% is just a rough guide. Everyone's circumstance's are different so individual discretion is important.

You might also wonder why not talk about gold and silver exchange traded funds (ETFs)? Ok then, such ETFs

are highly convenient as you can purchase them like stocks and use them for derivative strategies like options. Occupying a useful role in the form of hedging and getting exposure to precious metals(possibly even including the mining of them) in smaller amounts in the short term. However at the end of the day like stocks they are "paper assets" that represent but are not a true substitute for ownership of the physical form of the metals. So its kind of like real-estate ETFs that represent ownership of real-estate, but do not fully and directly link to ownership of physical real-estate. So they do

Now you probably want to know what forms of gold and silver are best?

The following are among the best forms to hold precious metals in.

Bullion Coins

Bullion generally refers to value coming from metal weight rather than other factors like the design the metal has been formed into.

Bullion Coins allow for a fast and easy way to exchange precious metals provided the right kinds are bought. This is quite simple and comes down to choosing the most recognized and accepted ones such as the;

American Gold Eagle

American Gold Buffalo

Canadian Gold Maple Leaf

Gold Krugerrand

and Australian Gold Philharmonics gold coins.

For silver coins the;

American Silver Eagle

American Silver Buffalo

Canadian Silver Maple Leaf

Australian Silver Philharmonics

and Sunshine Mint Silver Round, are widely recognized and exchanged coins.

The coins listed above are among the most common ones in the exchange of precious metals. Thus they are reliable and trusted globally. These coins also often come in fractional forms such as 1/2 or 1/10 the size to allow for more flexibility in the exact amount and value of metal you desire. That being said, the most common form is ounces (Oz) of gold and silver

Sometimes Coins, especially non-bullion coins can have additional value on top of the metal alone because of manufacturing appeal, design, and reputation of the coins. Also keep in mind gold and silver coins, even the bullion kind are rarely 100% pure gold & 100% pure silver coins. This is because these metals especially gold are often combined with other metals to make an alloy, otherwise the precious metals would be too soft and delicate on their own. So realistically coin purity content is in the 90-99.99 percent range.

Collector coins can increase in value considerably and be worth far more than the coins listed above. However just like any other collectibles it is only best to deal with such collectibles if you are knowledgeable on them.

Bars & Ingots

These are often called the most concentrated store of value because virtually all the value comes from the precious metals themselves and not additional factors such as coin type. There is low to no premium(additional value) that is found with minted coins, This is good for those looking to own more metal per dollar

since they are not paying for additional costs of metal after it is crafted into coins or jewelry.

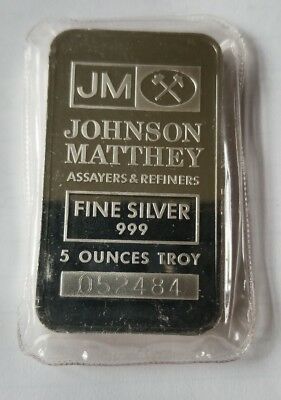

Some highly recognized and commonly exchanged forms of silver are;

the 100 Oz Johnson Matthey Bar, and 10 Oz Scottsdale

"Stacker".

Some highly recognized and commonly exchanged forms of gold are;

the 1 Oz to 100 Oz bars.

Bars are specifically designed to be stored and stacked so they are a great option for larger stores of wealth.

However bigger isn't always better. Wafer sized, and sheet or leaf gold and silver are also very useful. Small bars and thinner forms of precious metals are more divisible, less prone to counterfeits since counterfeiters often only go after the more valuable big bars. Think of having smaller quantities of precious metals as having smaller bills such as 20s and 50s as opposed to only 100 dollar bills which are more like 1 oz of gold or larger bars.

stamping: is a great way to check the reputability of the metal you will own. Stamps should include; weight, purity, refiner, and registration number to ensure maximum authenticity.

Also look for bars with reputable hallmarks(the bar brand or refiner/manufacturer)

Some of the most recognized refiners globally are; Johnson Matthey, Argo Heraeus, SA. Volcambi, As well as Sovereign Mints like the Royal Canadian Mint, or Perth Mint.

Junk Silver

This is a misleading term that has unfortunately stuck. It essentially refers to miscellaneous forms of silver. This can be in the form of old coins. such as U.S. coins like dimes, nickels, quarters, pre 1964. Many countries actually had precious metals in their circulated currency in the past. Silver may also be found in cutlery and dishes which was also more common in the past.

Jewelry

Jewelry on its own already has plenty of sentimental value since it is often given as a great gift. When it is also used as an investment it can be a potent form of wealth. Like coins, precious metal crafted into jewelry can retain wealth and grow in value considerably. It is also advantageous compared to coins and bars in that it is often not taxed in most places. There is also less of a need to declare it when one is looking to transport wealth in a low key way. This is because unlike coins, bars, and ingots, jewelry can just be an accessory and not arouse attention as a primary store of wealth.

One important note is to look for investment grade (22 karat) not 14 karat which is "scrap gold" which is harder to get the full value of the metal content.

Where And How To Purchase Gold & Silver: What To Look For

The first option is to start local from a trusted exchange or vendor. This is the most convenient option and it is easier to check the integrity of the precious metals dealer who is local. It is best to get to know the dealer and build trust with them. This allows for more secure dealings and can lead to some great deals that can only be done through personal local relationships.

Going local is great but it is not always an option depending on where you live. An alternative method to owning gold and silver is to use an intermediary such as a stock broker or agent who deals with precious metals. This solves the issue of not having a local precious metals exchange or vendor. However not all stock brokers handle physical gold transactions and it can be hard to find an agent who does. Some may also charge additional commission fees.

The third option to owning precious metals is using online exchanges and vendors. This solves the problems of the first two options. Gold and silver can be acquired with fewer barriers. It is also a less conspicuous way to own precious metals as you can have deliveries sent in discreet packages as opposed to walking into a local exchange. This is very important for those who want to remain secure and not arouse a lot of attention. However you should still be aware of a few things especially relevant when dealing with physical precious metals through online exchanges and vendors. Below are some things to keep note of.

Your objective is to become a precious metals owner who purchases as close to the "spot price" (also called the "current market price" as possible. It is exceptionally rare and near impossible to acquire gold or silver at the exact market price. It is normal to own the precious metals at around 2-5% above market price for either metal before even accounting for packing and delivery costs. This minor addition to the market price is to cover the refining, mining, manufacturing and distribution costs of the metals in whatever form they come in, whether it be coins, bars, or jewelry.

It is desirable to have a site that accepts multiple payment methods. Though remember using certain methods may be more expensive than others. This mainly concerns credit cards which are a less guaranteed form of payment since they technically use borrowed money as opposed to direct deposited funds.

Be aware that like stocks, currencies, real-estate and any other market, precious metals have a bid and ask price too. So there will be some disparity between buying and selling prices.

Check third party ratings on large accreditation databases such as the BBB (Better Business Bureau) or Trust Pilot Rating.

It is also desirable to deal with sites that have a smooth transaction experience of just purchasing precious metals directly without the need to make it complicated by spamming you with additional offers and services. It is ok if you are shown a promotion or two but when you can't just click and buy without having to be flooded with offers, that is just plain annoying. Intentions may not be malicious but just to sell more. In any case overpromotion and pushy sales tactics are best avoided.

Check for repeat customers and customer experience reviews. Repeat customers are a good sign of a site with integrity. Though remember to read what customers say and put it into context. Don't simply look at a 1-5 star rating and judge a site based on that alone.

A buy back policy also adds additional confidence as the site is literally putting its money where its mouth is and willing to buy back or have you sell to them.

Also like local vendors and exchanges, take caution and know who owns the site. It should be easy to find out the history and ownership of the site on their about page and sites like their BBB(Better Business Bureau page.

Such transparency is essential for basic trust.

Long (and constant) wait times can be a red flag. However it can be due to peak rush periods when precious metals are in high demand, or when orders are placed on Fridays and weekends. The key word here is "constant."

Has the site been in business a long time? The longer the better.

Bigger businesses are generally more secure and reliable as they have more resources.

Is there insurance on the metals and delivery? Insurance is important on such valuable assets such as precious metals.

Does the site have good security? Does it protect payment information? An easy rule of thumb is to look on the address bar and check if there is a padlock icon that encrypts information sent on the site by default. This is good practice for any secure web browsing in general. It may look different depending on what browser you use but the padlock and https:// are what to look for. Also in general take care of your online privacy and security, buying online may be more physically discrete but it still has a digital information trail you want to keep low profile.

Lastly if a deal is too good to be true it probably is.